Coffee Farmers Struggling to Cultivate Non-Blue Mountain Crops

Kingston, Jamaica – Jamaican coffee farmers, particularly those cultivating non-Blue Mountain varieties, are facing increasing challenges that threaten their livelihoods. Despite a recent surge in overall coffee production, the disparity in prices and support for Blue Mountain and non-Blue Mountain farmers has widened.

The Blue Mountain range stretches along the eastern side of the island, while coffee from the High Mountain region (also known as non-Blue Mountain) is primarily produced in the central and western parts. Quality Blue Mountain offers coffee lovers a complex flavor profile with notes of spice, chocolate, and fruit, while High Mountain coffee typically has a more intense chocolate and spice flavor with a slight bitterness. Despite the higher quality and premium price of Blue Mountain coffee, the challenges faced by farmers in both regions are significant.

Difficult farm access on steep slopes, high fertilizer costs, farm theft, diseases, and the changing climate make farming Blue Mountain coffee a risky venture. Many farmers are struggling to make a profit, even with the higher prices. “They want us to plant more beans, but it just doesn’t make any sense most of the time,” said the head of Middleton Cafe in the Blue Mountains.

The price disparity between Blue Mountain and non-Blue Mountain coffee is evident at the consumer level as well. A cup of Blue Mountain coffee can cost up to $3.50 at Middleton Cafe, while a cup of High Mountain coffee at Smurfs Cafe in Treasure Beach is only $1.00.

According to the Planning Institute of Jamaica, while Blue Mountain cherry coffee production increased by 16.2%, non-Blue Mountain cherry coffee production declined by 1.3%. This trend can be attributed to several factors, including the higher prices offered for Blue Mountain coffee, which incentivizes farmers to focus on this more lucrative crop.

The recent increase in Blue Mountain prices has further exacerbated the economic divide between farmers. The average farm gate price for Blue Mountain cherry coffee has risen to $367,433.3 per tonne (or roughly US$2,450 per tonne), while non-Blue Mountain cherry coffee remains at $119,415.8 per tonne (about US$800 per tonne).

This price disparity has led many non-Blue Mountain farmers to abandon their crops in favor of more profitable alternatives. The decline in non-Blue Mountain production is not only a loss for these individual farmers but also a blow to the country’s agricultural diversity and the overall economy.

Efforts to address this issue include providing targeted support to non-Blue Mountain farmers, such as technical assistance, improved access to markets, and potentially higher subsidies. Additionally, exploring new markets for non-Blue Mountain coffee and promoting its unique qualities can help to increase demand and improve prices.

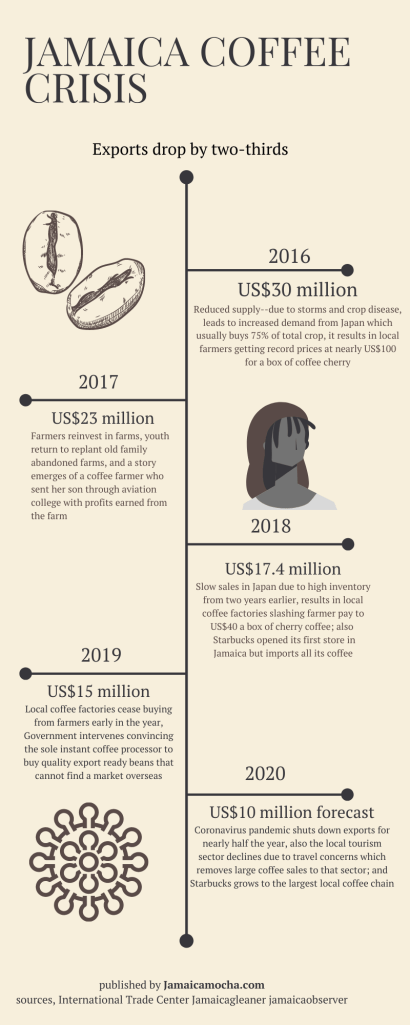

Crisis isn’t new to coffee. Below is a timeline from before the pandemic.